Wrapped Bitcoin (WBTC) is a digital version of Bitcoin that runs on the Ethereum network (ERC-20). Simply put, it is “Bitcoin wearing an Ethereum suit.”

Its value is always pegged 1:1 to real Bitcoin. Its primary goal is to enable Bitcoin holders to utilize their assets in Decentralized Finance (DeFi) applications, lending, and trading on platforms that do not support the original Bitcoin blockchain.

What is Wrapped Bitcoin (WBTC)? (The Simplest Analogy)

Let’s start the story with a simple analogy. Imagine you travel to a new country carrying your expensive electronic device (Bitcoin). However, upon arrival, you discover that the electrical wall socket in this country (Ethereum Network) has a completely different shape, and you cannot insert your device’s plug into it.

You own the device (Value), and electricity exists (Network), but you cannot utilize it because the ports are incompatible. Will you throw your device away? Of course not.

The solution is simply to use a “Travel Adapter”!

This is exactly what Wrapped Bitcoin (WBTC) does. It acts as the adapter that allows your Bitcoin to function and connect seamlessly within the Ethereum network, retaining its original power and value, but in a form that fits the “sockets” of the new network.

To understand this fundamental difference, you can review the Difference Between Bitcoin and Ethereum. Simply put, Bitcoin’s Blockchain technology does not know what Smart Contracts are on Ethereum, and here is where WBTC steps in as a bridge.

How Does Wrapped Bitcoin Work?

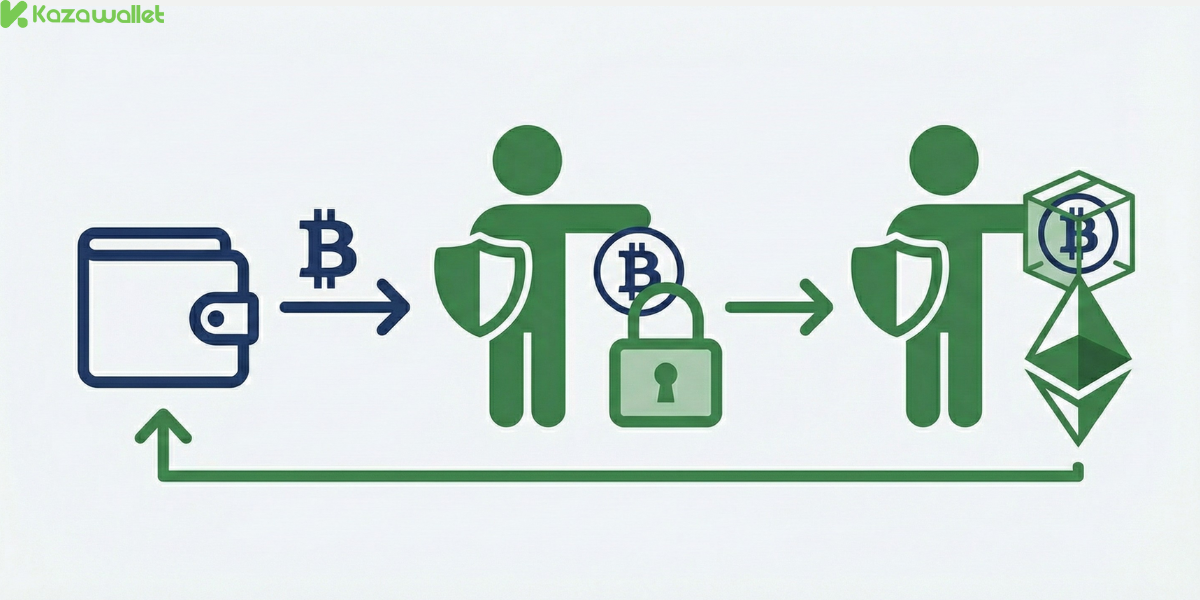

The concept mirrors a “Certified Check” in banking. To obtain WBTC, the process occurs through three logically simple steps (even if technically complex in the background):

- Deposit: You send real Bitcoin to a trusted “Custodian.”

- Lock: This custodian locks your Bitcoin in a digital vault to ensure it is never used twice.

- Mint: Once the Bitcoin presence is verified, an exact equivalent amount of WBTC is minted (issued) on the Ethereum network and sent to your wallet.

The reverse is also true: When you wish to reclaim your Bitcoin, the WBTC tokens are burned, and the original Bitcoin is released back to you.

This process is completely different from Bitcoin Mining, which requires energy and complex hardware; WBTC is created programmatically the moment the asset is secured.

Who Manages This Process?

To ensure no single party manipulates the system, it is governed entirely by a Decentralized Autonomous Organization (DAO). This organization comprises a coalition of merchants, custodians, and major institutions in the crypto world.

Their task is to vote on any changes to smart contracts and to add or remove merchants/custodians. This guarantees that the system relies on consensus rather than a single individual who might make errors or act maliciously.

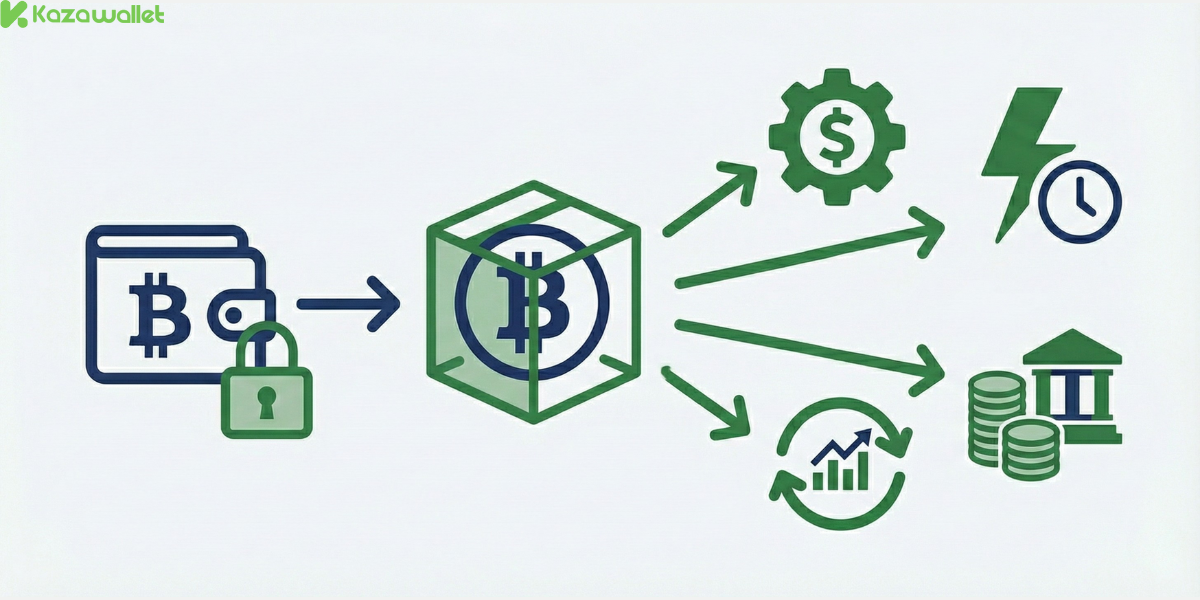

Why Would You Need to Wrap Your Bitcoin?

You might ask: “Why not just keep Bitcoin as it is?” The answer lies in missed opportunities. Bitcoin in its original wallet is often “lazy”—it sits there waiting for price appreciation. WBTC, however, opens new doors for you:

1. Entering the World of DeFi

The largest financial applications (like Aave, Compound, and Uniswap) are built on Ethereum. Using WBTC, you can earn returns through staking or yield farming while maintaining a 1:1 value ratio with BTC. This bypasses the limitations of the basic Bitcoin network, which does not support complex smart contracts.

2. Speed and Cost

Transactions on the Ethereum network (or associated Layer 2 networks) can be faster than the original Bitcoin network, facilitating easier asset movement between platforms.

3. Decentralized Trading (DEXs)

Decentralized exchanges do not accept standard Bitcoin. If you wish to swap Bitcoin for another currency without going through a centralized exchange, you must convert it to WBTC first.

4. Borrowing Against Bitcoin (MakerDAO)

Do you need cash liquidity (Dollars) but refuse to sell your Bitcoin? Through platforms like MakerDAO, you can place WBTC as collateral and take out a loan in a stablecoin like DAI. This way, you access cash while retaining ownership of your Bitcoin.

WBTC vs Original Bitcoin

| Feature | WBTC (Wrapped) | Original BTC |

| Network | Ethereum (ERC-20) | Bitcoin Network |

| Use Cases | DeFi, Lending, DEXs | Store of Value, Transfers |

| Decentralization | Partial (Custodian Trust) | Full / Absolute |

| Speed | ~15 seconds/block | ~10 minutes/block |

How to Wrap Bitcoin into WBTC (Step-by-Step)

There are two methods to obtain WBTC: one for institutions and one for everyday users like you.

Method 1: For the Everyday User (Easiest & Fastest)

You do not need to perform the technical wrapping process yourself.

- Choose a Platform: Use a centralized exchange (like Kazawallet) or a decentralized one (like Uniswap).

- The Swap: Simply trade Bitcoin (BTC) for Wrapped Bitcoin (WBTC).

- Receive: WBTC will appear in your wallet instantly, ready for DeFi use. This method saves you the trouble of dealing with merchants and custodians.

Method 2: The Official Process (Merchants & Institutions)

This is where actual minting happens, occurring in 3 stages:

- Request: A Merchant requests the system to mint a new amount of WBTC.

- Send: The Merchant sends real Bitcoin to the Custodian to be stored in a secure cold vault.

- Mint: After confirming Bitcoin receipt, WBTC units are created and sent to the Merchant’s wallet.

Is Wrapped Bitcoin Safe?

Here, you must be aware of a crucial point. Original Bitcoin (BTC) is characterized by being completely decentralized; no one controls it. Wrapped Bitcoin (WBTC), however, requires a degree of Trust.

- You trust the entity holding the original Bitcoin (The Custodian).

- If something happens to this entity or the central vault is compromised, the wrapped coin could lose its value (De-pegging).

- However, WBTC is managed by a DAO including highly reputable crypto companies to ensure transparency, and anyone can verify on-chain that the Bitcoin in the vault equals the WBTC in circulation.

What are the Best DeFi Protocols for Using WBTC?

Once you hold WBTC, a complete world of financial applications previously closed to Bitcoin opens up. Here are the most famous ones:

Aave & Compound:

- Use: Lending and Borrowing.

- Benefit: Deposit WBTC to earn annual interest (APY), or use it as collateral to borrow stablecoins (like USDT) without selling your Bitcoin.

Uniswap & Curve:

- Use: Liquidity Mining.

- Benefit: Place WBTC in liquidity pools to earn a share of the trading fees paid to the platform.

MakerDAO:

- Use: Minting Stablecoins.

- Benefit: Use WBTC as collateral to generate DAI stablecoin.

Quick Comparison: WBTC vs. Other Wrapped Coins

You might have heard of other versions like renBTC or tBTC. What is the difference?

| Features | WBTC (Wrapped Bitcoin) | renBTC / tBTC (Alternatives) |

| Mechanism | Centralized: Relies on a custodian trusted by the DAO. | Decentralized: Relies on algorithms and smart contracts (Bridges). |

| Liquidity | Very High: Most widely accepted worldwide. | Low: Less liquidity and limited acceptance on platforms. |

| Security | Relies on the reputation of the managing firms. | Relies on Code Strength (which may contain bugs). |

| Verdict | Best for beginners and institutions due to stability. | An option for absolute decentralization purists (but more complex). |

Frequently Asked Questions (FAQ)

Can I unwrap WBTC back to BTC?

Yes, easily. This process is called Unwrapping or Burning.

- On Platforms: Simply sell WBTC for BTC at any time.

- Technically: A burn request is sent, prompting the custodian to unlock the original Bitcoin and return it to you.

Is WBTC always pegged 1:1 to Bitcoin price?

Yes, WBTC is designed to be pegged 1:1 with BTC. While rare, de-pegging can occur due to vault issues, but transparency ensures stability.

Can I use WBTC for margin trading?

Yes, WBTC supports margin trading on platforms like Binance or Bybit, allowing for higher potential returns (with higher risk).

What are the main risks of WBTC?

- Custodian Risk (Trust in the holding entity).

- Network Risk (Ethereum gas fees or smart contract bugs).

- Market Risk (DeFi volatility).

Conclusion: Should You Use It?

If you are a long-term investor (HODLer) who prefers keeping assets in a cold wallet for maximum security, Original Bitcoin is your best choice.

However, if you are an active investor wanting to put your capital to work for extra returns or wish to utilize decentralized finance applications, Wrapped Bitcoin (WBTC) is your golden ticket to riding the Ethereum train with the value of Bitcoin gold.

Ready to start? Read How to Buy Bitcoin via Kazawallet] to begin your journey.

Blog Kazawallet

Blog Kazawallet