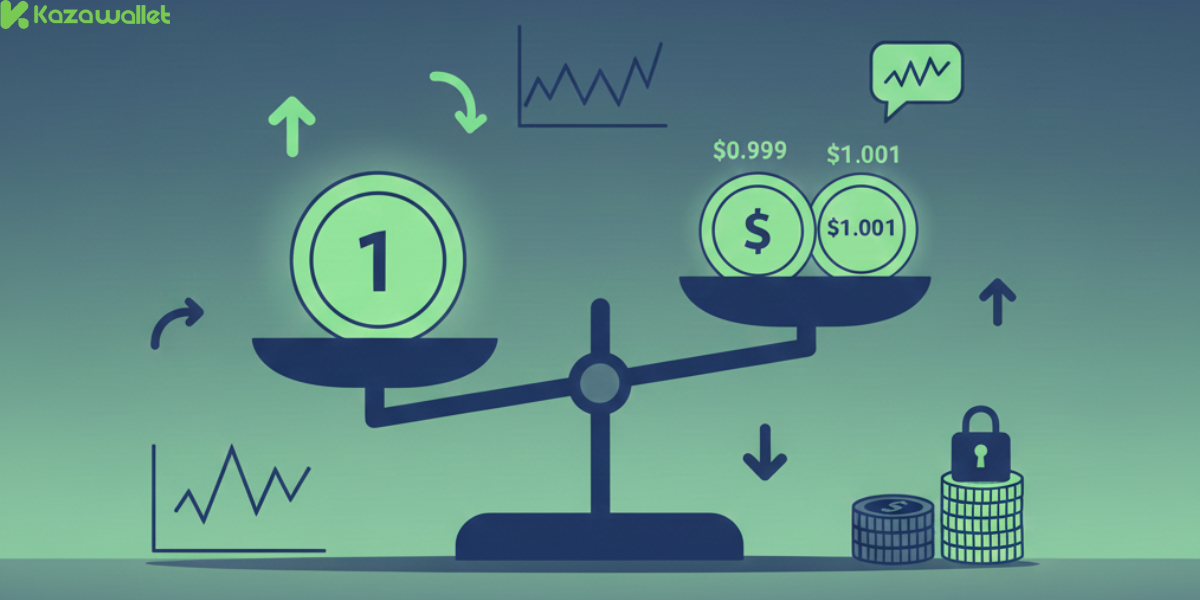

while tracking your wallet or an exchange, you might notice something strange: the price of USDT isn’t exactly $1.00! You might see it at $0.99 or perhaps $1.01.

At this point, has the coin lost its stability? Is my money at risk?

The price of USDT fluctuates slightly due to supply and demand on exchanges, liquidity gaps, and transaction fees. This minor volatility (between $0.99 and $1.01) is perfectly normal and does not signal a collapse.

We will explain why the price of USDT sometimes differs from one dollar, why these fluctuations occur, when they are normal, and when you should pay attention.

Is USDT the Same as the Dollar?

In reality, USDT is not the dollar itself; it is a digital currency that tracks the price of the dollar. The relationship between them is called a “peg.”

Imagine the real dollar is a person walking, and USDT is their shadow. Most of the time, the shadow follows the person with perfect precision. However, under certain conditions (like the angle of light), the shadow might move slightly ahead or fall slightly behind.

To understand more about the role of these currencies, check out our article: What are Stablecoins? And Why are They Useful?

Why Do We See USDT Prices Change to 0.999 or 1.001?

This slight variance is a daily technical occurrence driven by three main factors:

1. Market Dynamics (Supply and Demand)

Although Tether promises that every 1 USDT is backed by $1 in its reserves, trading on exchanges is subject to market laws.

- Sudden Surge in Demand: Just like any commodity, if demand for USDT spikes—for example, during a massive Bitcoin crash when everyone rushes to the safety of stablecoins—the price may rise slightly above $1 (e.g., $1.002).

- Massive Sell-offs: If panic leads people to sell USDT all at once, the price may dip slightly (e.g., $0.998) before returning to the $1 level once the market stabilizes.

2. Exchange Fees and Liquidity

Every exchange has its own liquidity pool, fee structure, and order execution method, which creates tiny price differences.

- High Liquidity Exchanges: The gap between buying and selling prices (the spread) is minimal, keeping the price very close to $1.

- Smaller Exchanges or P2P: You may see slightly higher or lower prices due to hidden fees, wider spreads, or slower execution compared to major platforms.

3. News and Rumors

The crypto market is highly sensitive to news, whether confirmed or just rumors.

- If a rumor spreads regarding the issuer’s reserves or potential regulatory bans, users might rush to sell, causing a temporary price dip.

- Conversely, positive news or increased adoption of USDT on new platforms can drive demand, pushing the price slightly above $1 for a limited time.

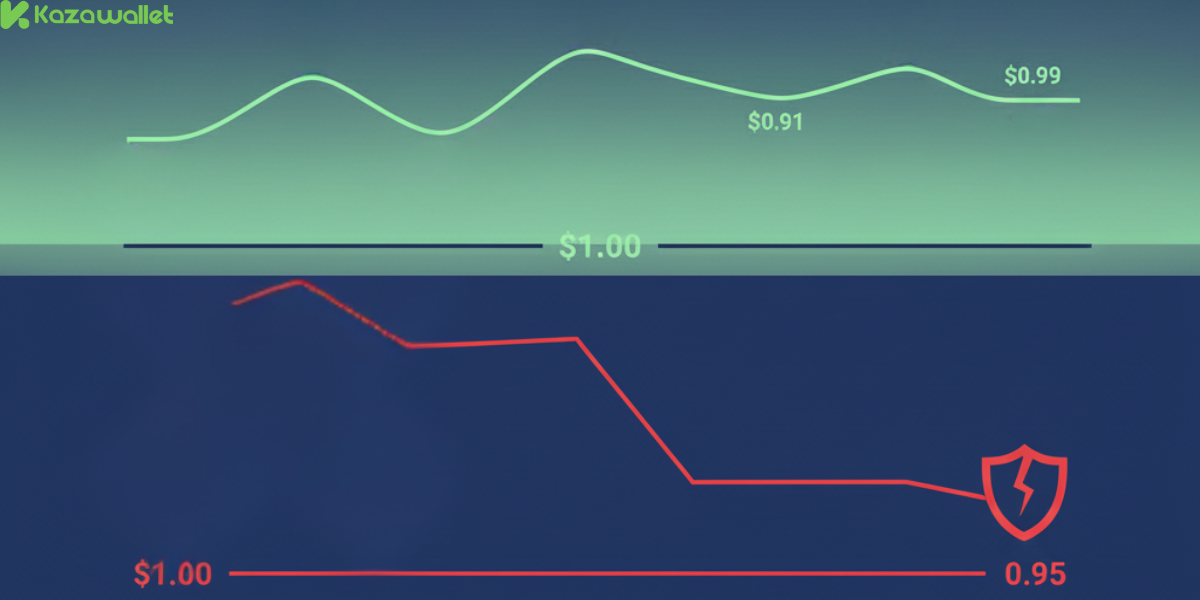

Normal Volatility vs. Dangerous De-pegging

It is vital to distinguish between daily fluctuations and a crisis.

Normal Volatility Around $1

This involves price movements within a very narrow range (less than 1%), such as between $0.99 and $1.01, followed by a swift return to $1.00.

This is a daily occurrence in active markets and is a standard part of digital trading that does not require panic.

Real De-pegging (De-Peg)

A dangerous de-peg occurs when the price drops significantly further (e.g., to $0.95 or lower) and remains there for a noticeable period without recovery.

This is usually linked to a genuine crisis of confidence or fundamental issues with the stablecoin.

USDT Price Range Table: Normal vs. Danger

| Case | Price Range | What’s Happening? | What it Means for You |

|---|---|---|---|

| Natural Stability | $0.999 – $1.001 | Normal market activity | No need to worry |

| High Demand | $1.001 – $1.01 | Increased USDT buying | Possible tiny profit |

| Selling Pressure | $0.99 – $0.999 | Liquidity exiting crypto | Don’t sell at the bottom |

| Suspected De-peg | < $0.98 | Crisis of confidence | High risk; consider USDC |

Note: Normal USDT volatility is between $0.99 and $1.01. Anything below $0.98 is a warning sign.

What Should You Do When USDT Strays from $1?

- Don’t Panic: Price movements of a few cents are normal, especially during high market activity.

- Monitor Multiple Platforms: Check the price on various exchanges to ensure the deviation isn’t just a local issue on one platform.

- Diversify: If you hold very large amounts, consider distributing your balance between USDT and other alternatives like USDC to mitigate risk.

- Follow Official Sources: Don’t make major financial decisions based on social media fear “trends.” Rely on official news channels.

The Role of Kazawallet

At Kazawallet, the core idea is that you shouldn’t have to monitor exchange spreads to benefit from the stability of USDT.

- Secure & Instant Exchange: Instead of worrying about fluctuations on external exchanges, Kazawallet’s in-app exchange feature allows you to convert any crypto to USDT (and vice versa) with total price clarity and high security.

- Card Funding for Daily Spending: You can load your virtual Kazawallet Visa card directly with your USDT balance. This turns Tether’s stability into real purchasing power for coffee, subscriptions, or online shopping.

Our goal is to provide an experience where you feel like you’re carrying real dollars in your digital pocket—ready to use at any moment.

FAQ

Could USDT collapse like other currencies? The probability is extremely low due to Tether’s massive cash reserves and its current high levels of transparency.

Why does the price appear as $0.99 in my wallet? This is usually just a mathematical rounding or a real-time update from trading platforms; it typically returns to the correct $1.00 value shortly.

Do I lose money during this volatility? No, as long as you do not sell during a minor dip. Furthermore, its purchasing power within Kazawallet cards remains fixed and stable.

Is USDT safe for long-term savings? It is excellent for short-to-medium-term liquidity. However, for large savings, it is wise to diversify with USDC and not place all your funds into a single stablecoin.

What is the most secure stablecoin? Currently, USDT and USDC are considered the most secure and are the most widely used globally.

How can I buy USDT at a fair price? Through the Kazawallet platform, which provides competitive and stable exchange rates.

Conclusion

As long as the currency is backed by real reserves and maintains the trust of millions, the “shadow” will always follow its owner.

Enjoy your crypto journey, focus on utilizing and growing your balance, and leave the minor volatility concerns to the professional traders.

Blog Kazawallet

Blog Kazawallet